Systematic Investment Plan as the name suggest is one of the most systematic way to invest indirectly in equity markets at regular intervals that may be daily, monthly or quarterly.

For Example: If Arun has started off a SIP of Rs 5000, it means every month Rs 5000 gets deducted from his bank account and gets invested in a mutual fund scheme selected by him on a given particular day of the month

What are advantages of investing through SIP in Mutual Funds which takes you to become a Crorepati

There are two advantages of investing in mutual funds through SIP. Rupee Cost Averaging and Power of Compounding

Power Of Compounding

Let me explain this with the help of example. Suppose Abhishek started a SIP in Mutual funds in one of the best equity diversified funds of Rs 5000 in 2001. This means his total investment till December 2010 (a total of 120 installments) works out at Rs 6,00,000. As most of the mutual funds have given more than 16% returns from 2001, his wealth would have grown to around 18,00,000 in 2010 and if Abhishek doesnt invest more and stop his SIP at this time, after 10 years, he can expect his money to be around 90,00,000 (90 Lakhs),. nearly becoming a Crorepati assuming 18% returns in the next 10 years which is possible by right selection of mutual funds and monitoring it year after year. This is done with a investment of just Rs 5000 per month for 10 years i.e Rs 600000 of total investment.

Rupee Cost Averaging

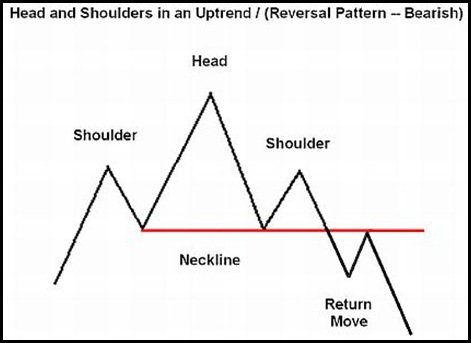

Rupee Cost Averaging is the process of buying mutual funds where you are a buyer at each level of market i.e at higher levels of market and at lower levels also. The mutual fund units purchased at lower levels gives you a chance to average out your investment at lower price and thus get significant returns. Mind you, even a 2% annualised returns can make a big difference to your mutual fund portfolio

Never under estimate the power of compounding. Invest systematically and become a double Crorepati by investing in mutual funds through SIP.

If you like this article, you may also read

For Example: If Arun has started off a SIP of Rs 5000, it means every month Rs 5000 gets deducted from his bank account and gets invested in a mutual fund scheme selected by him on a given particular day of the month

What are advantages of investing through SIP in Mutual Funds which takes you to become a Crorepati

There are two advantages of investing in mutual funds through SIP. Rupee Cost Averaging and Power of Compounding

Power Of Compounding

Let me explain this with the help of example. Suppose Abhishek started a SIP in Mutual funds in one of the best equity diversified funds of Rs 5000 in 2001. This means his total investment till December 2010 (a total of 120 installments) works out at Rs 6,00,000. As most of the mutual funds have given more than 16% returns from 2001, his wealth would have grown to around 18,00,000 in 2010 and if Abhishek doesnt invest more and stop his SIP at this time, after 10 years, he can expect his money to be around 90,00,000 (90 Lakhs),. nearly becoming a Crorepati assuming 18% returns in the next 10 years which is possible by right selection of mutual funds and monitoring it year after year. This is done with a investment of just Rs 5000 per month for 10 years i.e Rs 600000 of total investment.

Rupee Cost Averaging

Rupee Cost Averaging is the process of buying mutual funds where you are a buyer at each level of market i.e at higher levels of market and at lower levels also. The mutual fund units purchased at lower levels gives you a chance to average out your investment at lower price and thus get significant returns. Mind you, even a 2% annualised returns can make a big difference to your mutual fund portfolio

Never under estimate the power of compounding. Invest systematically and become a double Crorepati by investing in mutual funds through SIP.

If you like this article, you may also read

- SIP in Mutual Funds is the best

- Rupee Cost Averaging takes you to become a Crorepati

- Dont Trade but Invest for Simple reasons